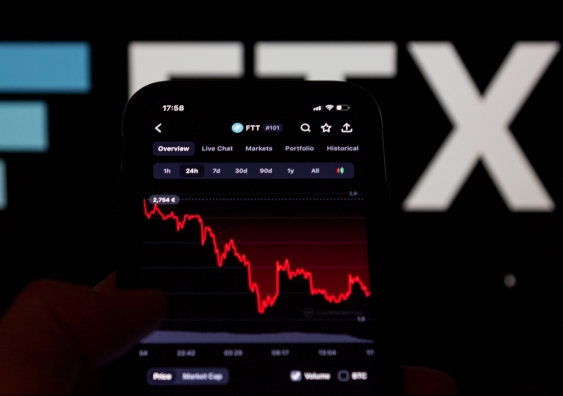

With the price of Bitcoin and other digital currencies dropping dramatically, what is in store for the digital asset market?

Like many other markets around the world, the crypto market is going through a particularly brutal time right now.

Sell-off in the popular cryptocurrency Bitcoin saw its value plunge to $US17,592.78 in mid-June - the first time since December 2020 that the value had dropped below $20,000. Similarly, Ether (also known as Ethereum) has also crashed along with Bitcoin, and was down more than 70 per cent from its all time high pricing in November last year.

On the business side, the world’s largest cryptocurrency exchange, Coinbase, has sacked 18 per cent of its staff. At the time, the co-founder quoted the current “crypto winter” as signalling an extended period of revenue loss for the company.

But is this a case of party over for crypto asset classes? Or is it just a slight blip on the bear market? Associate Professor Elvira Sojli and Dr Eric Lim of UNSW Business School explain what’s happening in the cryptocurrency market right now - and what the future might hold for crypto.

What is currently happening with cryptocurrency markets?

Elvira Sojli: The cryptocurrency markets have seen one of the worst months and years to date. Their value has tumbled, and most of the decrease has occurred over the last two months.

This depreciation is not unique to the crypto markets (although it is more pronounced here). Currently, they are following what is happening in the equity market more generally, where the SP500 stock market index has lost 23 percent in the year to date. All markets are getting affected by the increasing interest rates around the world, which makes money more expensive.

In general, as money becomes more expensive the opportunity cost of investing increases. In addition, demands/costs of investments elsewhere also increase, which push investors to take money out from the more volatile assets like crypto and equity to the safer assets, like cash and bonds.

Eric Lim: There can be a tendency when it comes to the crypto market to think it is divorced from global or macroeconomic events. For the record, it is not.

Currently, we are seeing a macro environment where all financial assets are having a bad time. In the US, the Federal Reserve (the Fed) is attempting to induce a global recession by raising interest rates. The last thing that any investors want to do is to fight the Fed on this. This means investors are going to deleverage most financial assets and seek safer investments.

Therefore, there will not only be selling pressure and weakness in the crypto market but also in the financial markets more generally.

Cryptocurrencies have a reputation for being notoriously volatile. Is the crypto market having its own Lehman Brothers’ style 2008 meltdown?

Elvira Sojli: Investment in cryptocurrencies was fuelled by ample money supply in search of returns, and the expansion in the retail market. And the retail market - a global term for the market of unsophisticated investors that invest on and off in the financial markets, but do not have large amounts of resources - found the returns very alluring.

A market like this, which is sustained by new money coming in, with increases in users or investor growth, without increases in the fundamental value attached to it, will run out of steam as there are fewer and fewer new market participants that can join.

This issue is exacerbated when the cost of money and market uncertainty increase, which is something we are seeing in today’s markets.

Eric Lim: Detractors of cryptocurrency will point to the volatility of crypto and complaints about less-than-ideal behaviors we have witnessed in the space such as price manipulations, toxic misinformation, tribal behaviors, and excessive risk-taking.

Yet as with any frontier technology, the market will always have trouble pricing the value of something like cryptocurrencies. We saw the same behavior during the dot.com era. Sometimes there will be over-exuberance and sometimes, there will be an overcorrection. That’s inevitable and anyone with knowledge of how markets work will know that time and education will lessen this volatility.

But there is no denying that crypto is having its own 2008 GFC moment. Like the Lehmann Brothers collapse, this is due to the age-old human story of greed, arrogance, and disregard for the responsibility bestowed upon certain individuals. In this case, certain platforms were not transparent with the loans it has been making and has failed to put in sufficient measures to mitigate risks in time of a downturn. As in any investing space, individuals in the crypto space who made these bad decisions without proper risk management on behalf of managing their clients’ wealth, should be prosecuted to the full extent of the law.

Now is this type of situation one that is specific to cryptocurrency? If one were to put aside their inherent biases against crypto, it clearly has nothing to do with the nature of the technology. Any financial market is going to attract such actors who overleverage and overestimate their abilities to absorb risks and are reckless with managing their clients’ wealth – both in cryptocurrency markets and the heavily regulated US financial markets.

It's a situation that is particularly poignant because, as cryptocurrency publication Coin Bureau pointed out recently over Twitter, “Crypto was meant to be the antidote… It was born out of the 2008 financial crisis - a crisis caused by reckless institutional leverage, illiquid assets, and severe counterparty risk. A crisis that caused mass contagion and financial losses,” they said. “We have come full circle.”

The cryptocurrency firms Celsius and 3AC have actually frozen withdrawals for their clients. What does this mean for cryptocurrency trading?

Elvira Sojli: Celsius is a crypto-based ‘bank-type’ company that attracts deposits from cryptocurrency holders by providing high-interest rates that they use to lend to borrowers willing to borrow in crypto. Celsius wants to attract investors that are distrustful of the banking system.

The problem is that the ‘deposits’ in Celsius are not guaranteed by deposit insurance provided by the Federal Deposit Insurance Corporation (FDIC), like normal deposit accounts. If Celsius goes bankrupt, depositors are not covered, and their investment is not recoverable.

Three Arrows Capital (3AC) is a cryptocurrency-based hedge fund. This is very different from Celsius. Access to hedge funds is limited to high-net-worth individuals (who have more than USD$1 million in investment assets).

The decrease in the value of cryptocurrencies has impacted both of these businesses as the value of their invested assets and collateral assets has halved over this year.

Eric Lim: Celsius acts not dissimilar to money market mutual funds in the US (though less regulated), while 3AC uses the usual aggressive portfolio management techniques to earn returns for their clients.

Thinking this sounds familiar? Of course, it does! This is because they are simply traditional financial institutions that are playing the same financial games in the crypto markets instead of the conventional financial markets.

When collateralized assets like cryptos lose their market values in a deleveraged market and hedge funds like 3AC can’t meet the margin calls, panic is going to set in for many investors or other lending platforms that have exposure to that fund.

So, how are cryptocurrency firms freezing access to withdrawals impacting crypto investors?

Elvira Sojli: With the very large decreases in all cryptocurrencies (over 33 per cent over the year and 57 per cent since the start of 2022, at best), a large proportion of their investments has been wiped out.

Indeed, cryptos like Bitcoin are now back to levels last seen in December 2017. Even those that have held Bitcoin since then have little to show for it for a close to five-year investment. If this market continues to consolidate and slide, the hit to retail investors will be quite large. This will impact their financial stability and future consumption.

Eric Lim: Mainly, people will lose money. And I have the utmost sympathy for these individuals who have misplaced their trust in the actors that poorly invested on their behalf.

But notice how we have not heard anyone calling for the Fed or the government to step in to bail these financial entities, as we saw in the 2008 crisis. No one is calling on Satoshi Nakamoto – the mysterious and unknown creator of the first blockchain database – to create more Bitcoins or any crypto assets to further devaluate the existing assets held by prudent and responsible investors.

Unlike during the 2008 Global Financial Crisis where the banks were bailed out, the general society cannot be extorted to foot the bill of a party that it wasn’t invited to. This is the key difference between a financial market of a decentralized nature (like blockchain) versus that of a centralized one.

Does all this cryptocurrency volatility signal more regulation of the space is on its way?

Eric Lim: Even before events were unfurling, it was clear that regulations were coming. Regulations bring clarity to a space, and the conversation has to start somewhere.

The Lummis-Gillibrand Responsible Financial Innovation Act was released last week in the US. It is a piece of legislation that – to my mind - possesses the right spirit with its understanding of the urgent necessity to protect retail and consumers in the crypto space from bad actors coupled with the understanding of the need to allow innovation in the cryptocurrency space to thrive.

Hopefully, all this will act as a wake-up call to those opportunistic actors who think they could act with impunity in this space by preying on the uninformed.

Elvira Sojli: I see the process of digitalization continuing, but the crypto market being much more consolidated.

Firstly, there will be a move towards digital currencies, centralised digital ledgers for different supply chains, and investment assets. For example, The US Federal Reserve has been specifically mandated to investigate ‘Ensuring Responsible Development of Digital Assets’ by President Biden’s exec order in March 2022. As part of this effort, there will be a renewed discussion on central bank-issued digital currencies. With this in mind, I believe we will converge on how we use digital currencies in the next decade.

In addition, the use case for digital distributed ledgers is still very strong in many types of businesses where climate footprint, provenance, and other data, are important to verify. So overall, in the future, the technology will become pervasive, and providers of such services will be companies one can invest in.

That being said - cryptocurrencies without a clear business case or peg to a profit-yielding business will not have a future. That is unless they can provide a more sustainable business model that yields returns.

Eric Lim: Even in these terrible market conditions, those who believe in crypto are still working on its future.

The technology inspires others - its ideals have taken root, and it will take more than this current volatility to quash that. The fundamentals of crypto haven’t changed and still represent individual freedom and self-sovereignty.

While fair-weather individuals who do not believe there is meaning to crypto beyond the accumulation of wealth might fall behind, the cryptocurrency caravan will move on with or without them.

Associate Professor Elvira Sojli is the President of the Financial Research Network and an expert in financial market structure and international markets. She can be reached to comment on the subject at e.sojli@unsw.edu.au.

Dr Eric Lim is the Founder and Director of the UNSW Crypto Clinic and Fintech Lead in the UNOVA Research Lab with extensive interests in cryptocurrencies and blockchain innovations. He can be reached to comment on the subject at e.t.lim@unsw.edu.au.