Be careful what you claim for when working from home. There are capital gains tax risks

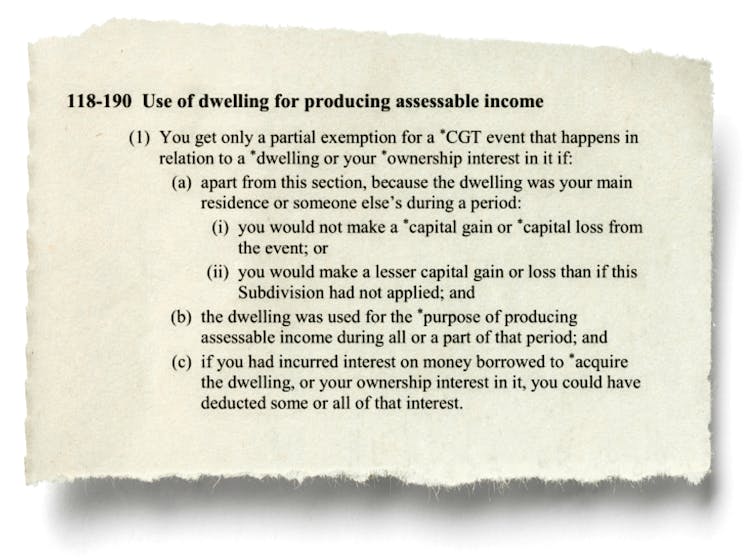

Claiming for working for home is fraught. It's safest to claim the running expenses the tax office allows. 'Occupancy expenses' are harder to justify and could cost you your capital gains tax discount.